Rethink Your Retirement Strategy

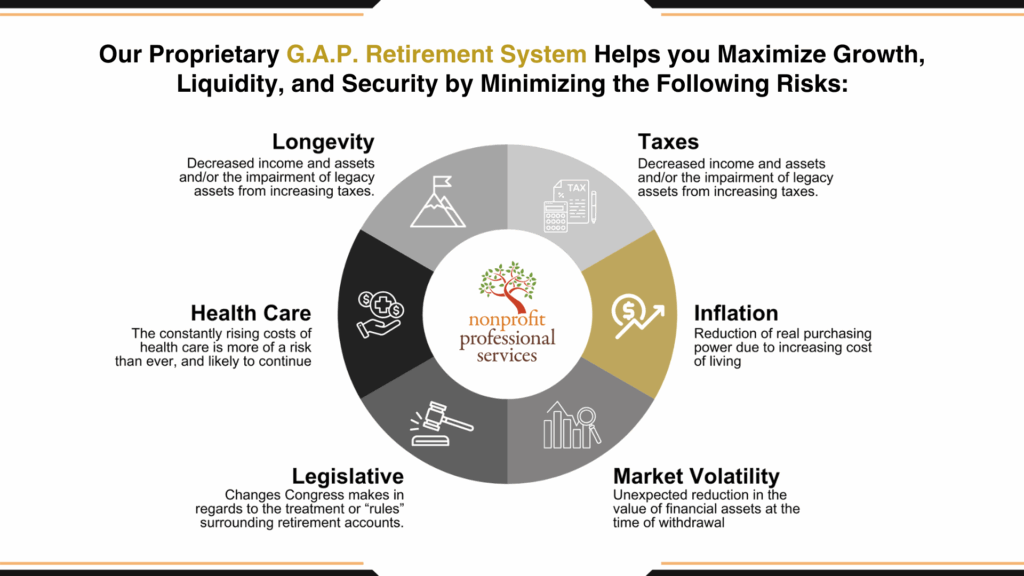

At Nonprofit Professional Services, we challenge the norm. We start with the end in mind. While most retirement advisors assist with designing investment portfolios with the right balance of mutual funds, we start with assessing the risks that can derail the best retirement savings plan.

Who we are

With decades of experience spanning both business and nonprofit sectors, I bring a unique, streamlined approach to retirement and tax planning. Having served thousands of clients and led numerous boards, I understand the complex financial landscapes of today’s professionals.

My mission is to provide strategic, personalized financial guidance that cuts through bureaucratic delays and delivers results. From nonprofit executives to high-net-worth individuals, I offer tailored solutions designed to maximize your financial potential and secure your future.

Key Differentiators:

- Proven Systems: Efficient, data-driven planning processes

- Dual-Sector Expertise: Deep insights from business and nonprofit worlds

- Personalized Approach: Custom strategies that align with your unique goals

Let’s transform your retirement planning with precision, speed, and strategic thinking.

What We Do

We review and analyze the five financial risks people face in Retirement.

We analyze each one: taxes, inflation, market volatility, longevity, and the cost of health care..

We prioritize each of the risks, then work with you and your financial advisors to develop a plan to address the risks of concern.

Each risk can be assumed, shared, or transferred, and we consider each one through that lens.

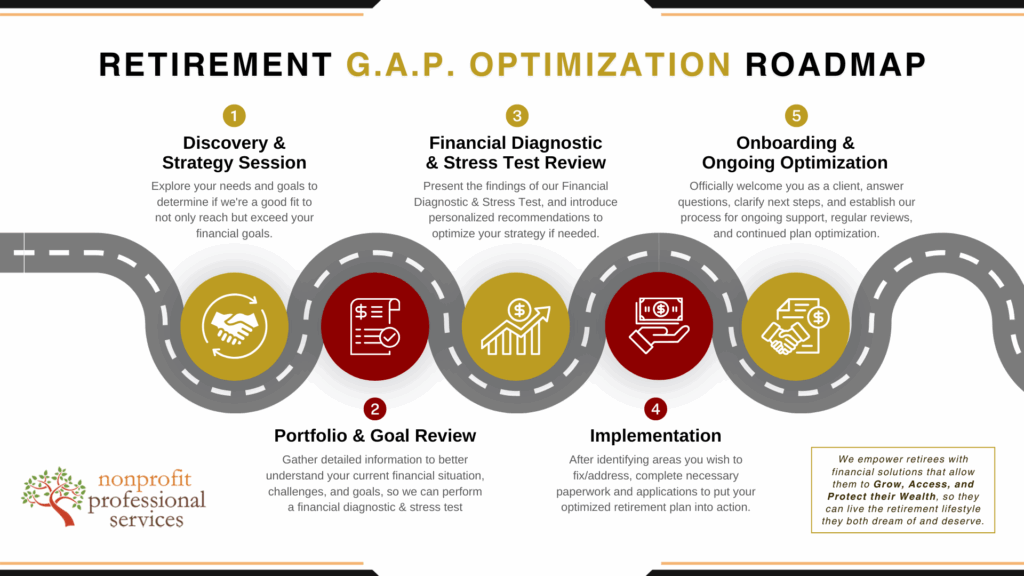

We use creative concepts to maximize how we design plans that other retirement advisors may not know or understand.

Services

Roth Conversions

Use smart Roth conversion strategies to grow tax-free income and gain more control over your retirement future.

Annuities

Retirement isn’t just about saving money. It’s about ensuring your income lasts your lifetime.

Charitable Giving

Leverage premium finance strategies to protect your wealth and expand your planning options without disrupting cash flow.

Long Term Care

Secure your future with a policy that offers long-term care coverage, ensuring peace of mind throughout your retirement journey.

Tax Strategies

Reduce your tax burden today — and in retirement — with forward-thinking, personalized planning.

Retirement Planning

Build a personalized plan that protects your future and adapts to real-life risks

Premium Finance

Leverage premium finance strategies to protect your wealth and expand your planning options without disrupting cash flow.

Executive Benefits

Design executive benefits packages that support your leadership teams and strengthen your organization.

Lifetime Income

Create a retirement income strategy designed to last as long as you do no matter what the future holds.

Estate Planning

Ensure your legacy is protected, your wishes are honored, and your loved ones are taken care of with a plan that’s easy to understand and simple to implement.

Testimonials

See what people are saying

Nonprofit Professional Services identified some areas of concern I was unaware of. I changed my retirement plan with the new information, which will make a big difference later. It will save thousands of dollars in taxes. I recommend taking the time to go through the process, which was quick and convenient.

Lori Willis, Executive Director, Santa Barbara Foundation

I am like most people, who don’t pay attention to retirement because it is in the future. I thought I would figure it out when I got there. I am so glad I took a few minutes to understand what could happen in retirement and the potential cost. I am glad to have put a plan in place while I am young. It takes the worry away. Tom and his team were knowledgeable and great to work with.

Ariana Hudson, Owner of Four Paws

Working with Tom and his team was a great experience. I am busy and procrastinating to sit down with a retirement advisor, knowing I need to put together all my financials, have multiple meetings, and devise a plan. The convenience of working with online meetings with Tom and his team makes the process painless. The financial tools are impressive and gave me the comfort of having tax-free retirement funds that I will not outlive. It was a positive experience, and I highly recommend Tom and his team.