Index Universal Life Funds

Is an IUL Best for Your Retirement?

Build a personalized plan that protects your future

and adapts to real-life risks.

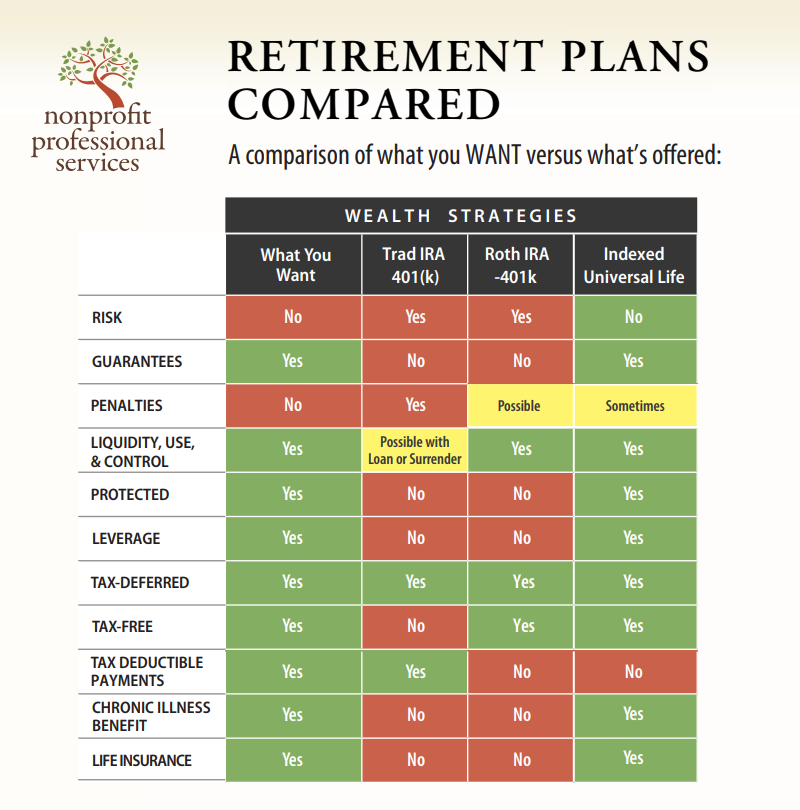

IUL vs. IRA/401(k)/403(b)

Market Exposure

Traditional plans like 401(k)s or IRAs invest directly in the market, exposing your retirement savings to potential losses in downturns. An IUL, on the other hand, ties cash growth to a market index but protects you from losses when the market drops.

Tax Flexibility

With an IUL, you can access your funds tax-free via loans or withdrawals. In contrast, traditional retirement accounts are taxed when you take out your funds (unless it’s a Roth account).

Life Insurance Coverage

Unlike IRAs or 401(k)s, an IUL provides life insurance coverage, ensuring your loved ones are financially protected even after you’re gone.

Long Term Illness

IUL policies have available a Chronic Illness benefit if the insured becomes chronically ill or cognitively impaired. This is a smart way to manage the expenses of a long-term illness.

Contribution Limits

IRAs and 401(k)s have annual contribution limits, which can restrict how much you save. IULs, however, offer more flexibility in how much you can contribute over time.

Why It Might Make Sense Converting to IUL

If you’re looking for more flexibility and protection in retirement, converting your IRA, 401(k), or 403(b) to an IUL can offer significant benefits. By rolling over your retirement savings into an IUL, you allow the ability to protect your savings from market downturns while still enjoying tax-deferred growth and tax-free withdrawals.

IUL Conversion with Kai-Zen Premium Financing

For those looking to intensify their retirement strategy, combining your IUL conversion with Kai-Zen premium financing could be a game-changer. This strategy allows you to leverage your existing retirement assets to purchase a higher-value IUL policy, without having to fully fund it out of pocket.

How Kai-Zen Works

Kai-Zen financing uses a combination of your contributions and third-party financing to pay for a larger IUL policy. This allows you to secure more coverage and cash growth potential than you could on your own. The idea is simple: by leveraging financing, you can maximize the benefits of an IUL while using less of your own cash upfront.

Benefits of Kai-Zen Premium Financing:

Benefits of Smart Leverage

No Credit Checks

No Loan Documents

No Personal Guarantees

No interest payments!

Benefits of Smart Leverage

Death Benefit with living benefit riders

Chronic Illness

Terminal Illness

Benefits of More Growth

Upside crediting (subject to cap)

No negative returns due to market decline

Tax-free distributions with potential to access cash value using tax-free policy loans.

Plan for Tomorrow, Today

Whether you’re considering rolling over your 401(k), IRA, or 403(b) into IUL or exploring the potential of Kai-Zen premium financing, our team at NPPSS is here to help you make the best decision of your financial future. We’ll guide you through every step, ensuring you have the knowledge and confidence to make the most of your retirement.