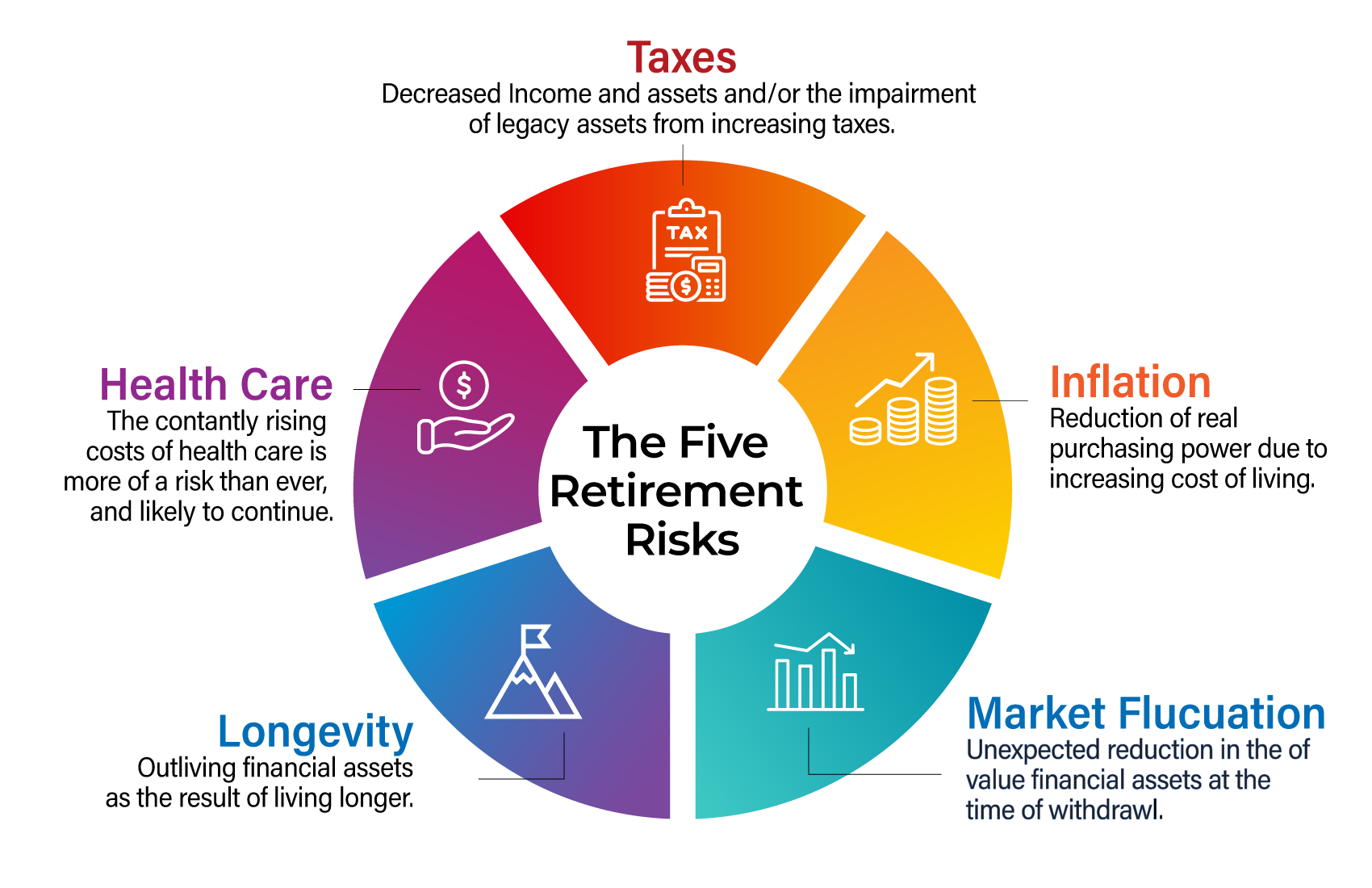

The Five Retirement Risks We Address

Build a personalized plan that protects your future

and adapts to real-life risks.

The Five Retirement Risks

Why Longevity is a Double-Edged Sword

- Living longer means more years in retirement

- Greater financial strain not properly planned

- Understanding key risks helps you stay secure

RISK #1

Outliving Your Savings

- Longer retirement means MORE WITHDRAWLS over time

- INFLATION erodes purchasing power over time and we're bound to see more in the future

SOLUTIONS INCLUDE:

Sustainable withdrawal strategies, GUARENTEED INCOME options

RISK #2

Inflation Erosion

- Over a 30-year retirement, inflation will SIGNIFICANTLY REDUCE value/buying power

- HEALTHCARE, housing, and daily expenses RISE

SOLUTIONS INCLUDE:

Health savings accounts, insurance, strategic planning

RISK #3

Healthcare & Long-Term Care Costs

- INCREASING HEALTHCARE costs with age

- Long-term care expenses (nursing homes, home care) are SIGNIFICANT and also increasing

SOLUTIONS INCLUDE:

Health savings accounts, insurance, strategic planning

RISK #4

Market Volatility

- Sequence of returns risk impacts early withdrawals

- Stock market fluctuations affect retirement funds

SOLUTIONS INCLUDE:

Balanced portfolio, risk management, income buffers

RISK #5

Changing Tax & Policy Landscape

- Tax rates may rise, impacting withdrawals

- Policy changes may affect Social Security & Medicare!

SOLUTIONS INCLUDE:

Tax-efficient withdrawal strategies, proactive planning

Start Planning Smarter Today

Retirement should be something to look forward to—not stress about.

Let’s build a plan that gives you confidence now and freedom later.